how much state tax is deducted from the paycheck

Federal income tax and FICA tax. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

How To Read Your Paycheck To Make Sure It S Correct Huffpost Life

Ad Web-based PDF Form Filler.

. There are seven federal income tax rates in 2023. In Indiana for example the. If a resident of Georgia is earning more than 200000 then an.

The deduction for state and local taxes is no longer unlimited. How Your Paycheck Works. The 10 rate applies to income from 1 to 10000 the 20 rate applies to income from 10001 to 20000 and the 30 rate applies to all income above 20000.

At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or. Use this tool to. From your paycheck the total tax constituting FICA is 29 Medicare and 124 Social security of your wages.

The amount of income tax your employer withholds from your regular pay depends on two things. Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

FICA taxes consist of Social Security and Medicare taxes. Divide the sum of all assessed taxes by the employees gross pay to. For 2022 employees will pay 62 in Social Security on the.

The amount you earn. In October 2020 the IRS released the tax brackets for 2021. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Heres how much state taxes could cost you. That includes overtime bonuses commissions. 1 day agoTaxpayers will receive rebates of up to 250 for individual filers and 500 for couples depending on how much state tax they paid and any debts that are deducted.

If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. In North Carolina The state income tax in North Carolina is 525. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

For example in the tax. It is a flat rate that is unchanged. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Edit Sign and Save Tax Deduction Worksheet Form. If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages. The state tax year is also 12 months but it differs from state to state.

Register and Subscribe Now to work on your Fighter Fighters Tax Deduction Worksheet Form. See how your refund take-home pay or tax due are affected by withholding amount. These amounts are paid by both employees and employers.

How Is Tax Deducted From Salary. Estimate your federal income tax withholding. Some states follow the federal tax year some.

The payer has to deduct an amount of tax based on the rules prescribed by the. Therefore it will deduct only the state income tax from your paycheck. The information you give your employer on Form W-4 and DE 4 if.

Taxes Compensation Career Center University Of Southern California

Visualizing Taxes Deducted From Your Paycheck In Every State

My Paycheck Administrative Services Gateway University At Buffalo

Bonus Tax Rate 2022 How Bonuses Are Taxed And Who Pays Nerdwallet

How Much Of My Paycheck Goes To Taxes

Hrpaych Reducded Payroll Services Washington State University

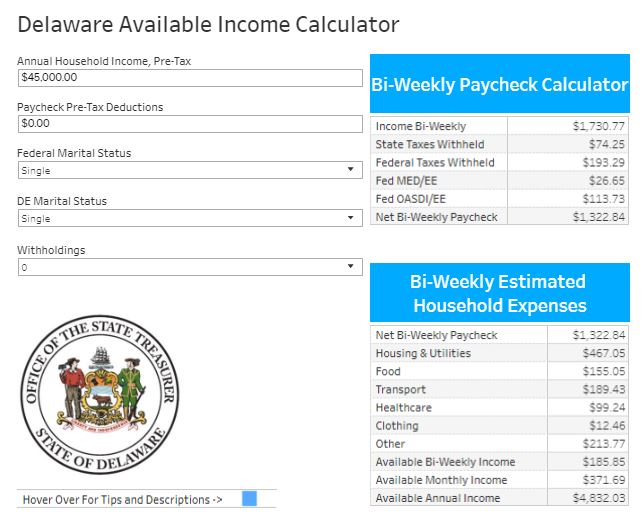

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Understanding Your Paper Pay Stub Cornell University Division Of Financial Affairs

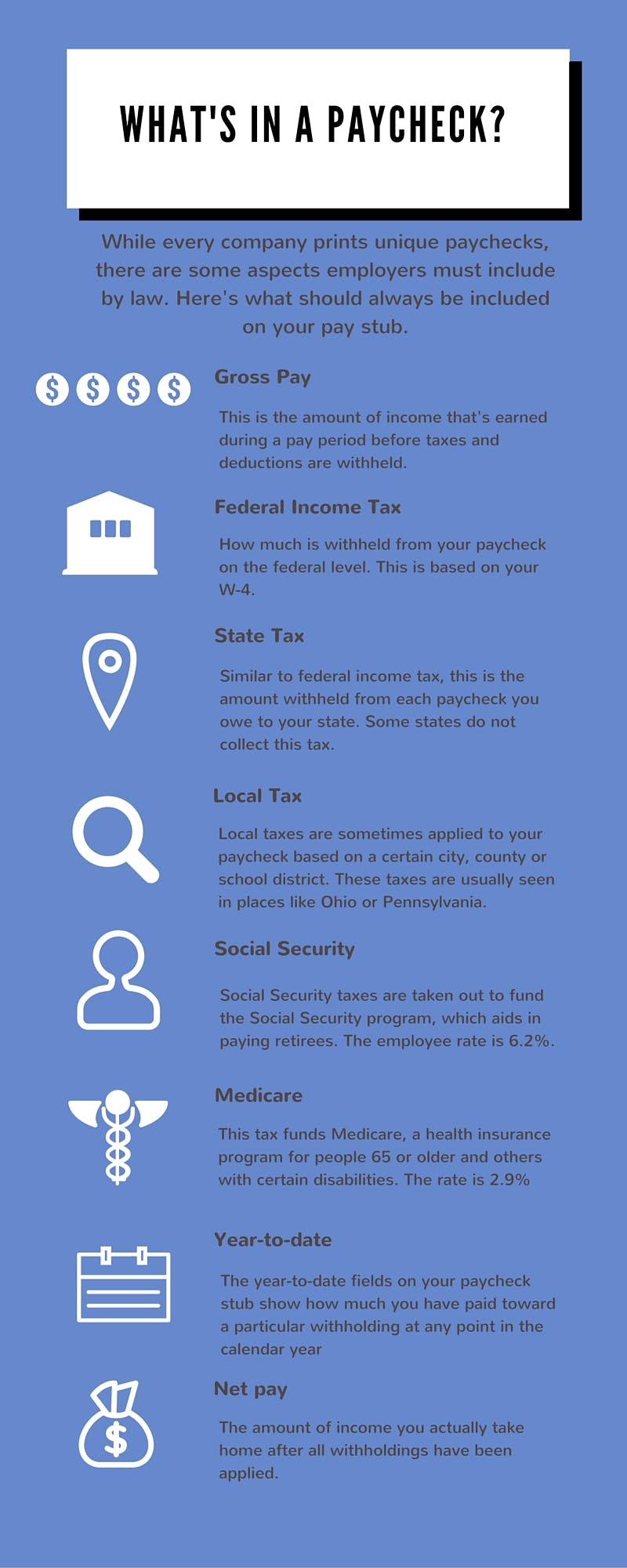

What Is Included In A Basic Paycheck Infographic Paycheckcity

Paycheck Calculator Take Home Pay Calculator

Your Pay Stub Portland State University

Pre Tax Vs Post Tax Deductions What Employers Should Know

2022 Federal State Payroll Tax Rates For Employers

Important Tax Information Work Travel Usa Interexchange

Free Paycheck Calculator Hourly Salary Smartasset

How Much Does Government Take From My Paycheck Federal Paycheck Deductions