are dental implants tax deductible in 2019

As one of the largest dental discount providers in the US with over 158000 dental practice locations 1Dental ranked as our top choice for dental discount plans. We would like to show you a description here but the site wont allow us.

Using An Hsa For Cosmetic Dentistry Dr Steve Marsh Dds

Contact your tax or legal professional to discuss details regarding your individual business circumstances.

. Providing health insurance coverage may also result in reduced payroll taxes. Members save the most when visiting a dentist who participates with Delta Dental. Medical and Dental Claims Administrator.

Everything from routine dental visits to prescriptions to doctors fees could earn you a credit at tax time. Unfortunately thats not always the case. The plan provides in- and out-of-network dental benefits with a small deductible.

All quotes are estimates and are not final until consumer is enrolled. Fifty percent of basic services are covered after the deductible in the first year then 65 in year. Tax Advantages and Benefits of Providing Health Insurance.

Veneers are covered only when medically necessary. Providers are able to submit claims electronically through acceptable clearinghouses as identified by the medical and dental claims administrator using payer ID 71064. Crowns can have issues that might require further dental work.

For example a 35-year-old non-smoking woman in Minneapolis would pay 276 in premium each month for the lowest price Bronze plan with a 7000 deductible that is unsubsidized. Once you get a dental crown you may think that your problem tooth is fixed forever. If you need tax advice please contact a tax professional.

Members cannot use two plans in the same office at the same time. A coinsurance applies for dental services after the deductible is met. Notice of 1095B for Tax Year 2020 02122021.

About Your MRA Who can I. Dental implants have. The annual deductible amount is 25 per covered person and not more than 50 for a family.

Winner of the 2018 Leadership Award in Dental Hygiene and the 2019 Award for Clinical Excellence Tabitha had dedicated her professional life to continued learning and sharing her passion with the dental community. Eligible health care expenses are health care costs that result from the diagnosis care treatment improvement or prevention of a disease or illness. The deductible may be carried over.

This territory was the sanctuary of the healing god Asklepios. If the applicable deductible is paid for a dental expense in the last quarter of the year October 1 to December 31 a new deductible will not be charged in the following calendar year. The first recorded instance of people travelling for medical treatment dates back thousands of years to when Greek pilgrims traveled from the eastern Mediterranean to a small area in the Saronic Gulf called Epidauria.

Introduction This guide includes a list of health care expenses and lets you know whether you can use the money in your Medical Reimbursement Account MRA to pay for the health care expense. Note you cant use. For instance if you had 3000 in dental expenses and made 20000 1500 of your expenses are deductible.

Such as teeth whitening or cosmetic implants would not be deductible. Important Health Fund Update to ALL UPS Full Time Employees Retirees 04272020. Publication 502 2019 Medical and Dental Expenses Accessed July.

Dental plan for the same location however returned Cigna 1500 and Cigna 1000 Dental insurance. You can order a copy of it by calling 1-800-TAX-FORM 1-800-829-3676 or read it online at irsgovpub502. Dental treatment - Medical expenses for dental treatment are reimbursable.

Tax Deductible Debt strategies Protecting your biggest asset your ability to earn income. Kaiser Family Foundation 2019. A 35-year-old woman in Dallas would pay 379 for a higher 8550 deductible plan.

And if you have a high deductible health plan HDHP you can fund a Health Savings Account HSA with pre-tax money and use it on a range of healthcare costs including dental. Spa towns and sanitaria were early forms of medical tourism. Fortunately your HSA can still allow you to use pre-tax money to pay your health insurance deductible.

Health insurance premiums that businesses pay on their employees behalf are generally 100 tax deductible. There is a 50 per person deductible for basic services when using a network provider and no copay for preventive care. This dental insurance is designed to help maintain good oral health whether you have natural teeth implants or dentures.

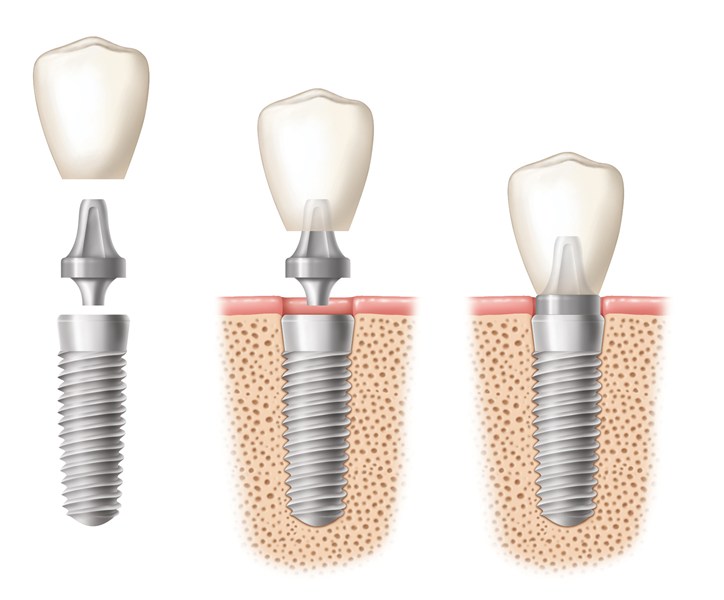

A single implant typically costs 2400-3000 but can be 4000-10000 or more if additional procedures like extractions bone grafts tissue grafts or a sinus lift are needed. Premium Payments by ACH. Qualified expenses include preventive services basic services major services and orthodontic benefits.

Medicare has neither reviewed nor endorsed this information. This includes fees paid to dentists for X-rays models and molds fillings braces extractions dentures dental implants and the difference in cost from insurance-approved restorations and alternative materials etc. If you are a senior or hold a valid disability tax certificate or are supporting a qualifying individual you can claim up to 10000 in expenses.

Assuming your HDHP covers just yourself no other family members you can contribute up to 3500 to your HSA in 2019 plus another 1000 if youre 55 or older. Unlike dental insurance dental savings plans enable people with pre-existing conditions to get affordable dental care. To 6 pm Monday through Friday excluding state holidays.

March 2021 SSM - Reduced Copays Dental Implants No Copay on COVID-19 Vaccines 02122021. Toll-free 800-323-4314 TTY 711. When you itemize the IRS allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2021.

Dental insurance premiums may be tax deductible. Significant tax advantages may be available to your business by offering health insurance coverage. Nov 2020 - Retiree Dental Access SMM 11012020.

There is no deductible for preventive care services. When a tooth needs to be restored a dental crown is often the best solution. Check out the IRS publication titled Medical and Dental Expenses.

Dental Gen insurance plans include coverage for preventive care like exams cleaning and X-rays basic fillings and major expenses such as root canals bridges or crowns. The crown encases the damaged tooth making it look and work like the original. The company has a no-annual-commitment policy and anyone in your family group can join--including your parents.

How much you can expect to pay out of pocket for dental implants including what people paid. New Fund Office Phone System 02122021. Medical expenses can add up quickly in the run of a year.

You can use your Health Savings Account HSA for out-of-pocket medical costs including dental and vision and dental and vision premiums. You cant use an HSA to pay health insurance premiums and if dental and vision are included as part of your plan rather than a standalone you may not be able to use it for that. Our quoting tool is provided for your information only.

Dentrix Tip Tuesdays Automatically Creating Secondary Insurance Claims Dental Insurance Dental Insurance Plans Cheap Dental Insurance

Are Dental Veneers And Implants Tax Deductible

Are Dental Implants Tax Deductible Drake Wallace Dentistry

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

Are Dental Veneers And Implants Tax Deductible

Taglio Di Capelli Spesso Parlato Raccontare Dental Compare Attaccamento Nuovo Significato Nel

How Can United Medical Credit Help Me With Dental Implant Financing United Medical Credit

Tax Tips Claim Back Your Dental Expenses North Queenland Family Dental