list of deductible business expenses pdf

Can claim a deduction over several years for example capital works borrowing expenses and the. Medical expenses include dental expenses and in this publication the term medical expenses is often used to refer to medical and dental expenses.

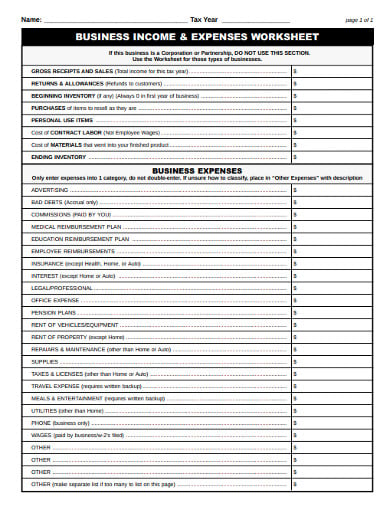

Expense Printable Forms Worksheets Spreadsheet Business Expenses Printable Small Business Expenses

Insurance generally is a contract in which the insurer agrees to compensate or indemnify.

. They effectively allow a taxpayer to write off the cost of. Copy A appears in red similar to the official IRS form. Nondeductible Tax Deductions Expenses.

According to Swiss Re of the 6287 trillion of global direct premiums written worldwide in 2020 2530 trillion 403 were written in the United States. The official printed 1040 form. Capital allowances are akin to a tax deductible expense and are available in respect of qualifying capital expenditure incurred on the provision of certain assets in use for the purposes of a trade or rental business.

Expenses deductible over a number of income years. The list of deductible business expenses includes obvious ones like office rent salaries and computers but might also include water bills and window cleaning. Read on to find information about deductions that can help your business save on taxes.

HAIRSTYLISTMAN ICURIST DEDUCTIONS ClientIDTax YearThe purpose of this worksheet is to help you organize your tax deductible hairstylistman icurist expenses. There are three types of expenses you may incur for your rental property that may be claimed over a number of income years. Deductible expenses are those that are seen as ordinary and necessary for conducting business.

Insurance in the United States refers to the market for risk in the United States the worlds largest insurance market by premium volume. There are three rental expense categories those for which you. Publication 502 explains the itemized deduction for medicaldental expenses claimed on Schedule A Form 1040 and the.

Remember however that you can only deduct the business use of the expense youre deducting. Copy A of this form is provided for informational purposes only. These expenses can range from advertising to utilities and everything in between.

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that. This list is relevant for many self-employed professionals. You can however deduct business-related trips made from worksite to worksite.

Can claim a deduction now in the income year you incur the expense for example interest on loans council rates repairs and maintenance and depreciating assets costing 300 or less. If you are unsure and deduct an expense on your tax return that does not qualify you might be faced with a tax notice or tax auditFortunately there are many deductible tax expenses that exist so you may be surprised that your tax expense of. That is you cant deduct the commute to or from home.

Information about Publication 502 Medical and Dental Expenses including recent updates and related forms. Amounts for decline in value of depreciating assets allowed only in certain circumstances capital works deductions. The cost of public transportation is deductible but must follow the same guidelines as car-related expenses.

Deductible Costs of Doing Business. Most folks are unclear whether a certain tax expense might qualify as a tax deduction or not.

Expense Tracking Spreadsheet Excel Form For Business Expenses Printable Small Business Expenses Business Budget Template

Small Business Tax Spreadsheet Business Worksheet Business Budget Template Business Tax Deductions

Inventory Management And Business Expenses Cash Flow Tracker Etsy In 2021 Business Expense Cost Of Goods Sold Small Business Planner

Business Budget Template Business Expense Expense Sheet

Truck Expenses Worksheet Spreadsheet Template Tax Deductions Printable Worksheets

12 Business Expenses Worksheet In Pdf Doc Free Premium Templates

Income And Expense Statement Template Beautiful Monthly In E Statement Template And Expense Re Business Worksheet Business Budget Template Spreadsheet Business

Independent Contractor Expenses Spreadsheet Business Tax Deductions Business Tax Small Business Expenses

What Expenses Can I Claim Free Printable Checklist Of 100 Tax Deductions Small Business Tax Business Tax Deductions Business Tax